MyFi Analysis Project (Excel, Power BI)

Skills applied

Data analysis, Dashboard design, Data integration, Data processing, Data visualization

Project Overview

The following is a personal finance data analysis project where I analyzed my spending patterns, income sources and financial health. I used data visualization and descriptive statistics to gain insights into the data. The goal is to identify areas where I can save money and make better financial decisions.

Objectives

- To work on a real-world data and save money.

- Embed Analytics into daily life.

- Financial Literacy at early age.

Questions that drive my Analysis:

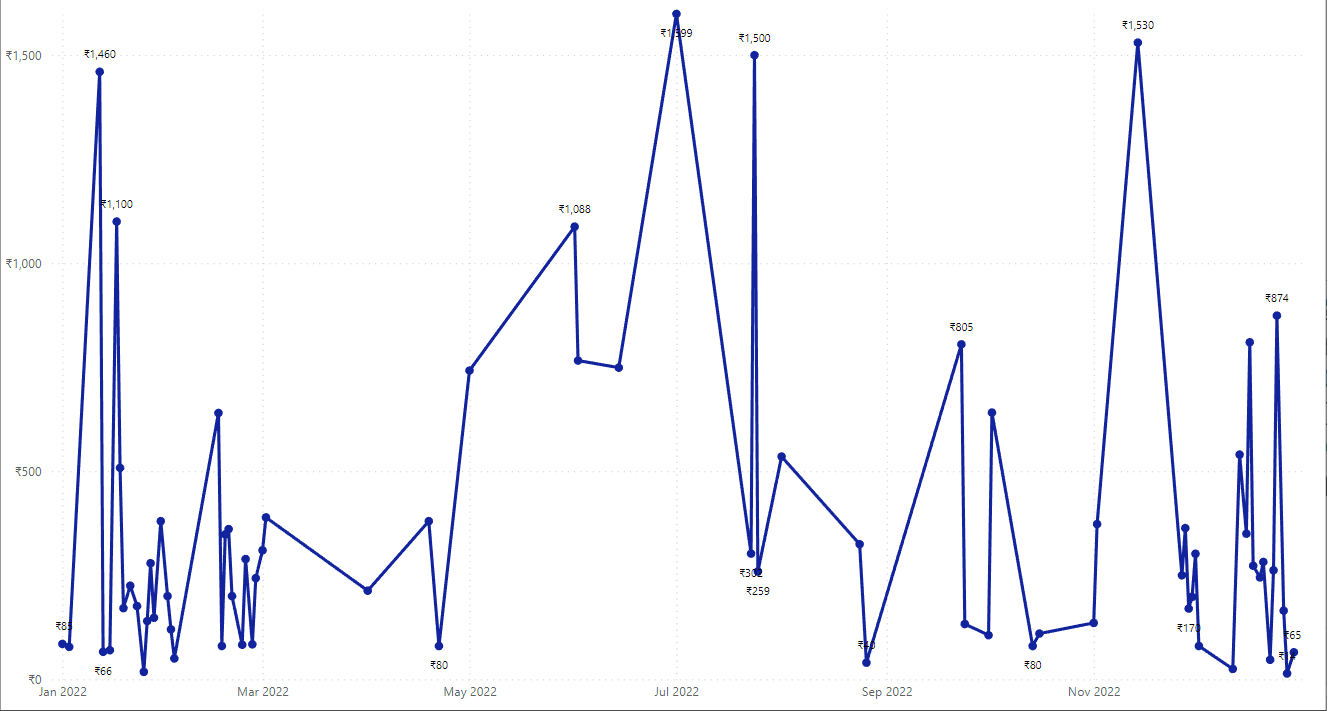

- What is my spending pattern?

- Which months are financially good or bad?

- Where does most amount of my money go?

- What is my net worth?

Preparation and Cleaning:

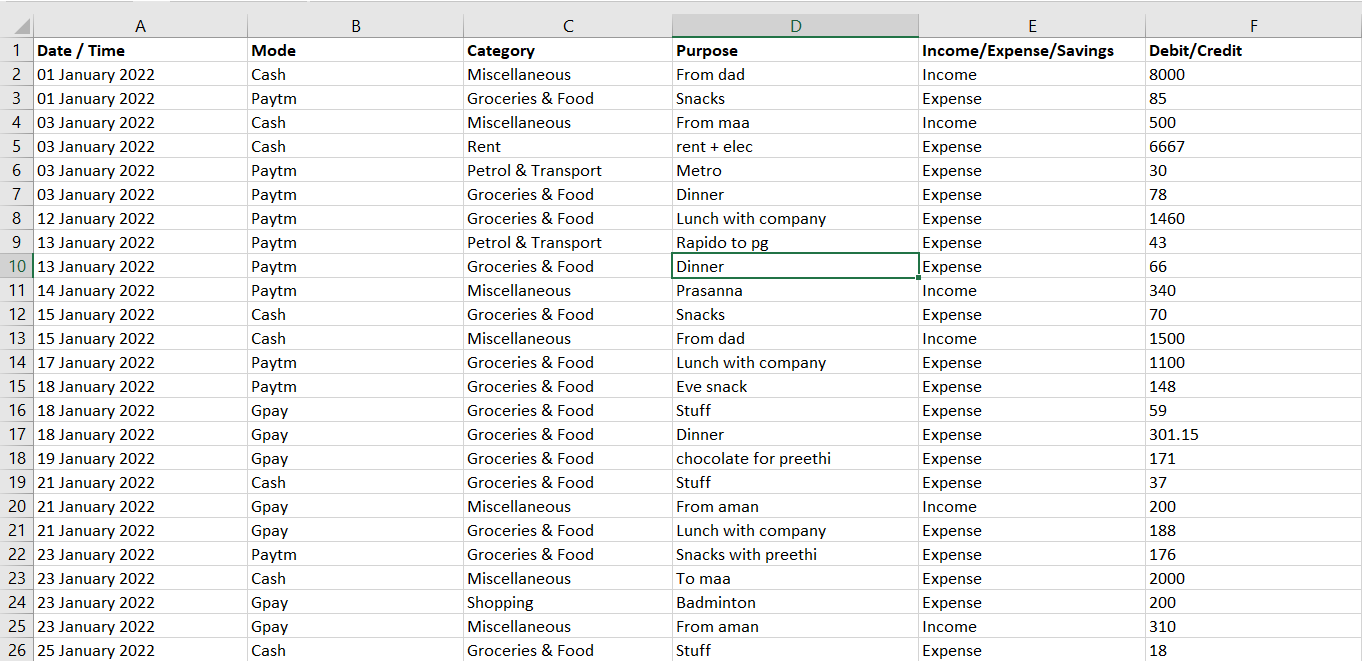

- Integrated data from multiple sources, such as bank statements, credit card bills, and investment accounts, to provide a holistic view of the my currrent financial health.

- The data for this project can also be collected from a personal finance tracking app or spreadsheet. The data will include date, description, category, amount and income/expense/savings variables.

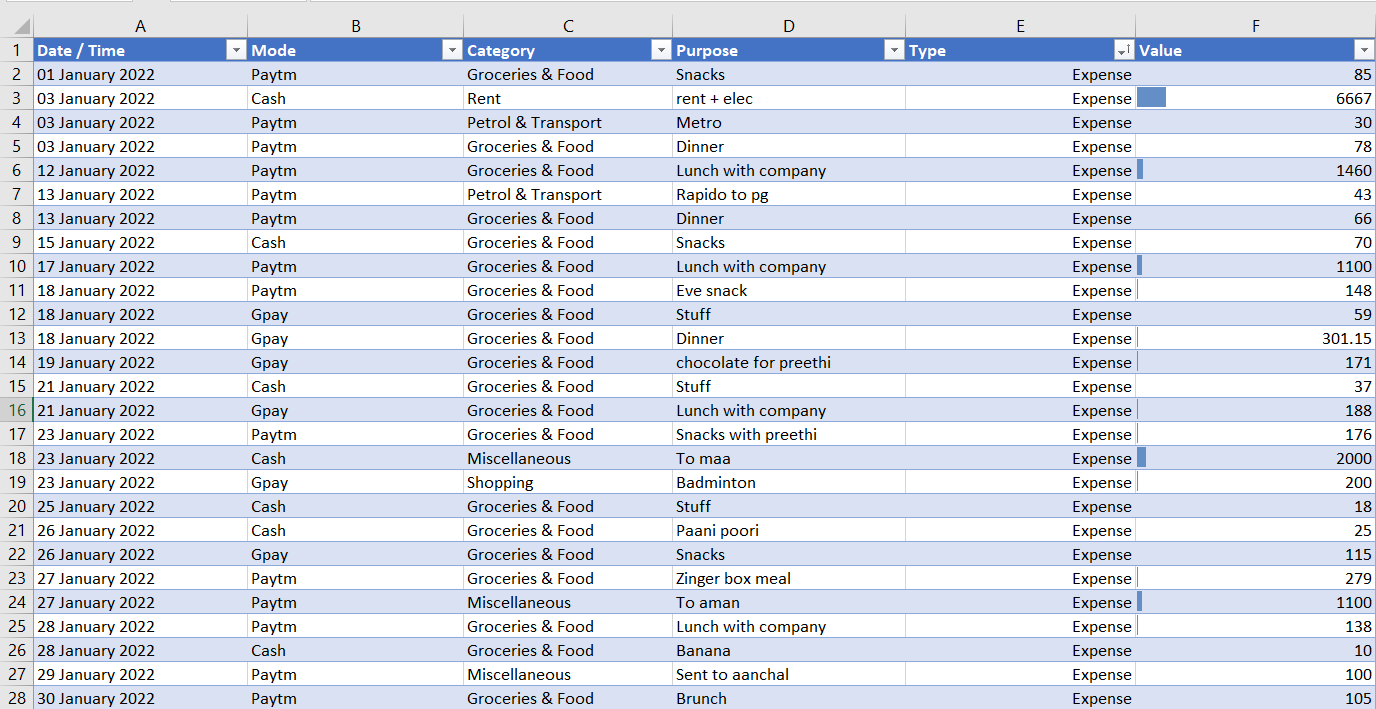

- You can see the raw data in this LINK As you can see in the image below, the format of the data was not appropriate for the analysis, so it had to be cleaned and prepared.

The activities performed were the following:

- Eliminate duplicates and cells that did not correspond to the data.

- Adjust the dates because they did not have the proper format.

- Created the date, values and category columns for the analysis.

Data analysis:

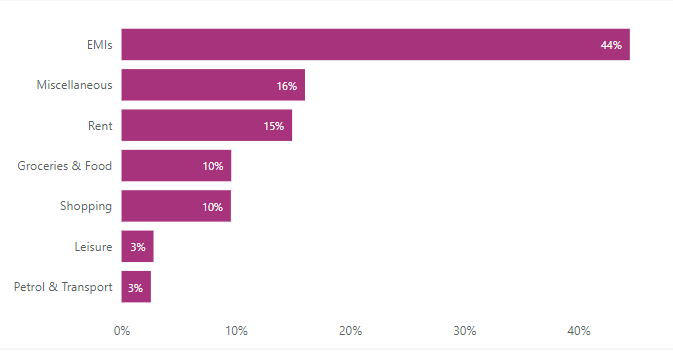

- Where does most amount of my earnings go?

- What is my spending pattern?

- Which months are financially good or bad?

Visualization

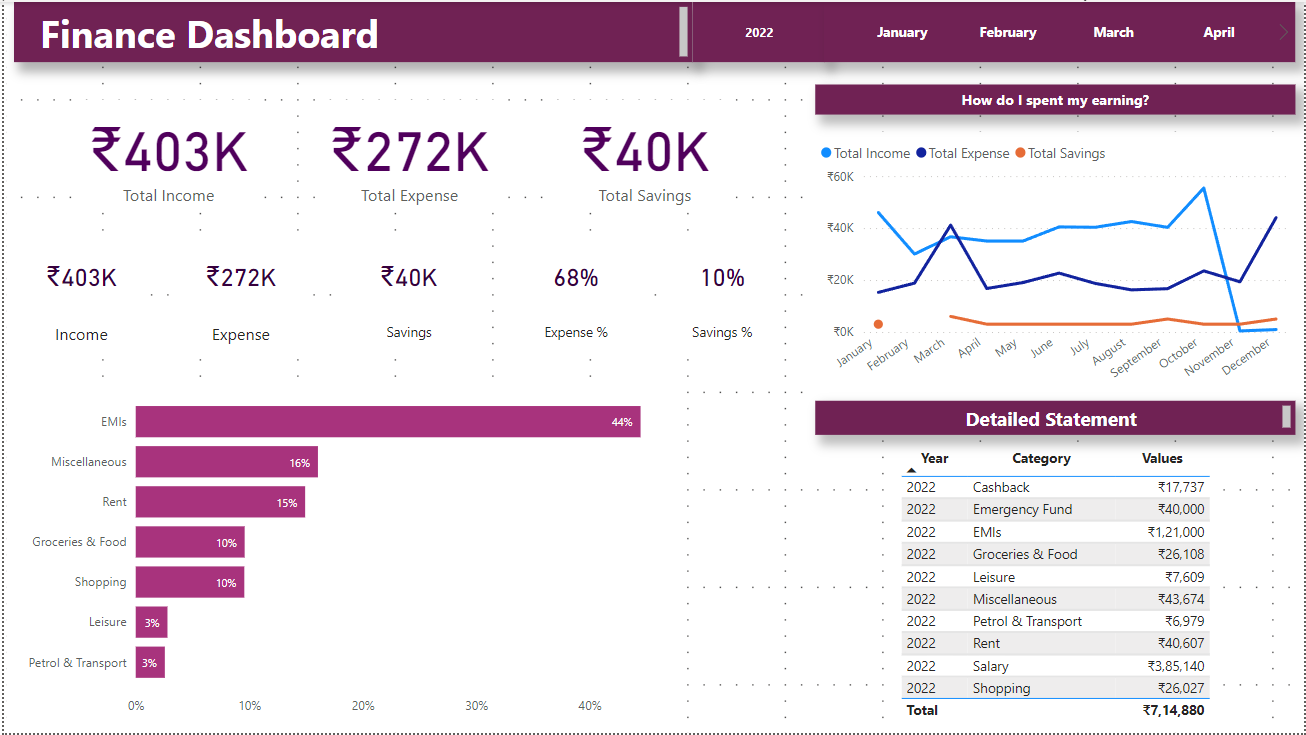

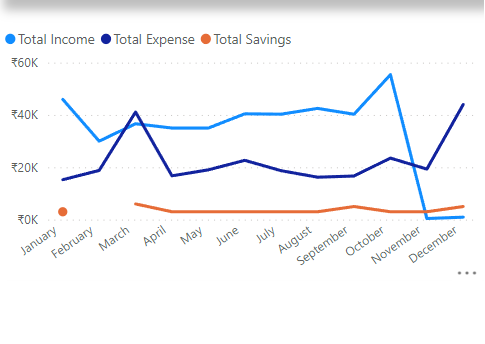

Finally we obtained a dashboard displaying monthly fluctuations. You can see the dashboard below and you can access the document by clicking on this LINK

Impact

- Improved financial outcomes: As a result of my analysis and recommendations, I was able to achieve 30% improvement in my financial health, including increased savings, reduced debt, and greater investment returns.